About Us

Overview

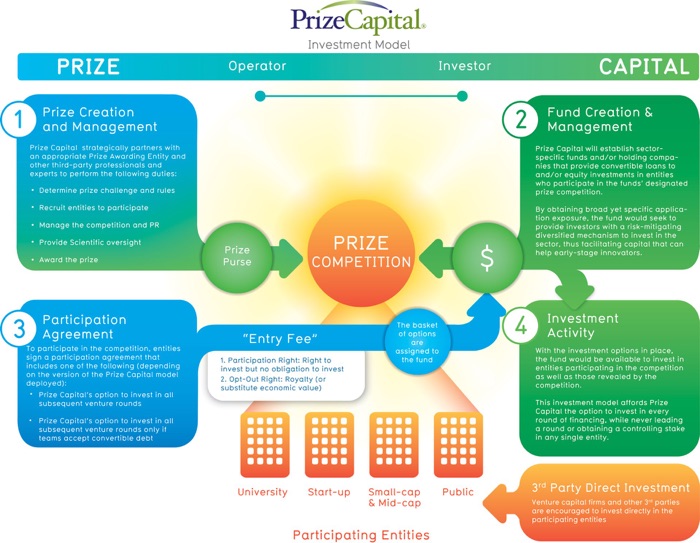

Prize Capital’s mission is to provide capital to early-stage innovators while mitigating risk for investors.

Traditional funding mechanisms are not designed to deliver capital to early stage or non-traditional innovators, preventing the world from benefiting from these innovations.

Prize Capital accomplishes its mission by deploying a proprietary financial model to support third-party prize awarding entities’ competitions. Specifically, the Prize Capital methodologies are designed to provide investment capital to individual competitors of these competitions.

Our Approach

There are many activities which a business or management team can schedule. Innovation, however, is impossible to schedule. It is also impossible to identify from where innovation may emerge. Since the vast majority of humanity does not have access to investment capital, enormous pools of talent are excluded from the innovation arena.

The culprit is risk. Methodologies to mitigate risk are essential in order to bridge the cultural gap and enable inclusion of all peoples in solving the problems facing our world.

Throughout history, prize competitions have proven to be a remarkable tool to enable breakthroughs. Prize competitions are especially powerful in inspiring solutions to problems outside the reach of conventional thinking. In fact, an estimated 30 percent of all prize competition winners originated from outside of the competition field.

Prize Capital merges the power of prize competitions with innovative financial instruments to facilitate capital for prize competitors. Additionally, risk is mitigated for investors by affording the ability to invest in numerous direct competitors - both those known and those unknown - without establishing a conflict of interest, an achievement impossible to accomplish on its own.

Prof. Josh Lerner, Jacob H. Schiff Professor of Investment Banking, Harvard Business School, performed early diligence on the Prize Capital model and deemed it "a novel way for investors to get exposure to a broad spectrum of approaches in emerging technologies" and that can "address exactly [the need for increased early stage investing] in a novel and powerful way." (The full analysis is available for download here)

The process of implementing the Prize Capital model is illustrated in the following diagram:

© Prize Capital, LLC

All Rights Reserved